Bitcoin, the pioneering digital currency, has recently faced a significant downturn, adding to the losses it accumulated during its most challenging week since November of the previous year. This decline is largely attributed to the anticipation of prolonged higher borrowing costs, which have dampened the appetite for riskier investments in global markets.

Bitcoin’s Current State

As of 9:53 a.m. in New York on Monday, Bitcoin’s value dipped nearly 1%, gravitating towards $26,000. This marks a near two-month low for the cryptocurrency, which lost over 10% of its value in the week leading up to Sunday. This downtrend isn’t exclusive to Bitcoin; other smaller digital currencies, including Ether and XRP, have also experienced drops.

The Global Bond Selloff and Its Implications

The global bond market is currently witnessing a selloff, with long-term US Treasury yields reaching multi-year highs. This selloff mirrors concerns about an extended period of restrictive monetary policies aimed at curbing inflation. Such an environment suggests limited liquidity, which could be problematic for riskier assets like stocks and, of course, cryptocurrencies.

Anticipation for the Federal Reserve’s Annual Symposium

The financial world is keenly awaiting the Federal Reserve’s annual symposium in Jackson Hole this week. All eyes will be on Fed Chair Jerome Powell, with his comments on Friday expected to provide insights into the future of monetary policy. Tony Sycamore, a market analyst at IG Australia Pty, shared his perspective, stating, “The market potentially is hoping there is going to be some dovish rhetoric coming out of Jackson Hole.” However, Sycamore remains skeptical, predicting a further 2% to 3% drop in the S&P 500 stock index (SPX) and foreseeing Bitcoin’s value plummeting to around $25,000.

Crypto Industry’s Silver Lining

Despite the prevailing macroeconomic risks, the cryptocurrency industry remains optimistic. One potential catalyst that could provide a boost is the pending applications for US spot Bitcoin and Ether futures exchange-traded funds (ETFs). Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, highlighted this sentiment, stating, “Despite the macro risk, there is a strong potential crypto catalyst in the wings: the listing of ETFs.”

Mixed Technical Signals

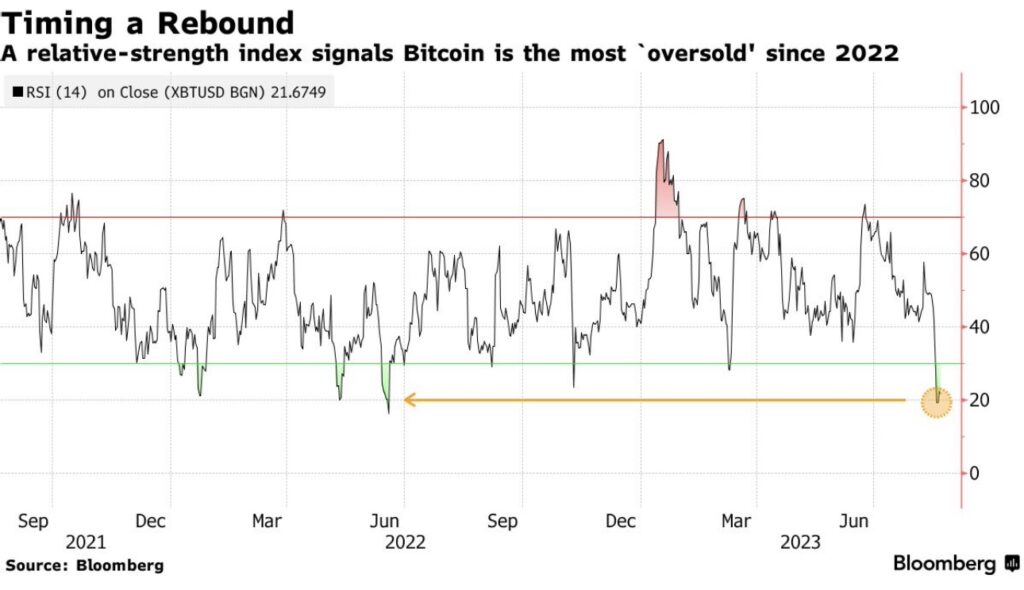

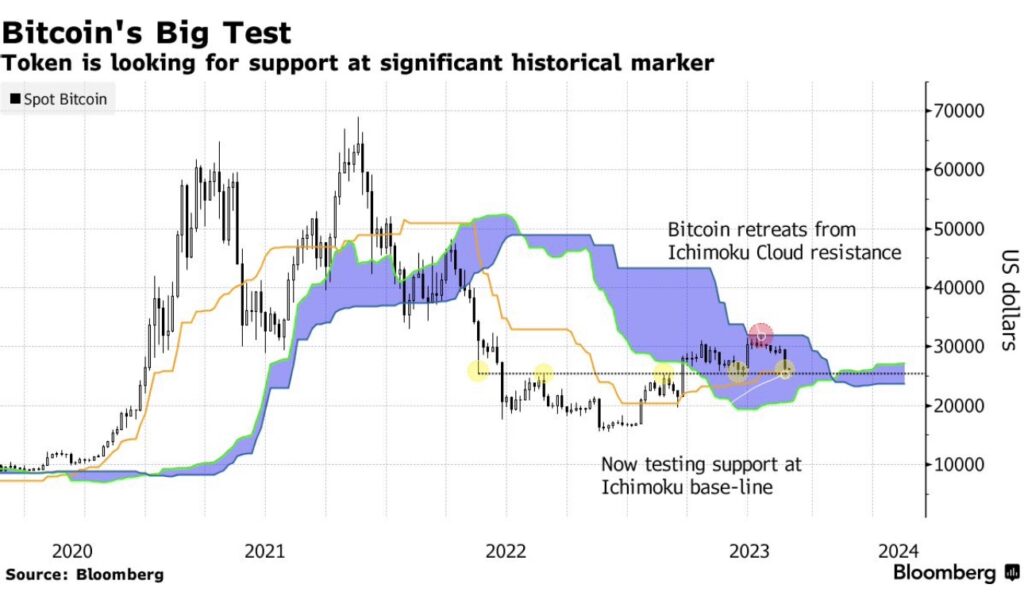

Technical analyses offer a varied outlook for Bitcoin. The 14-day relative strength index, a momentum gauge, suggests that Bitcoin is nearing its most oversold level since mid-2022. Conversely, the Ichimoku Cloud study, a mathematical tool used to determine resistance and support areas, indicates that Bitcoin might face a more significant downturn if its value drops below $25,700.

Comparing Past and Present

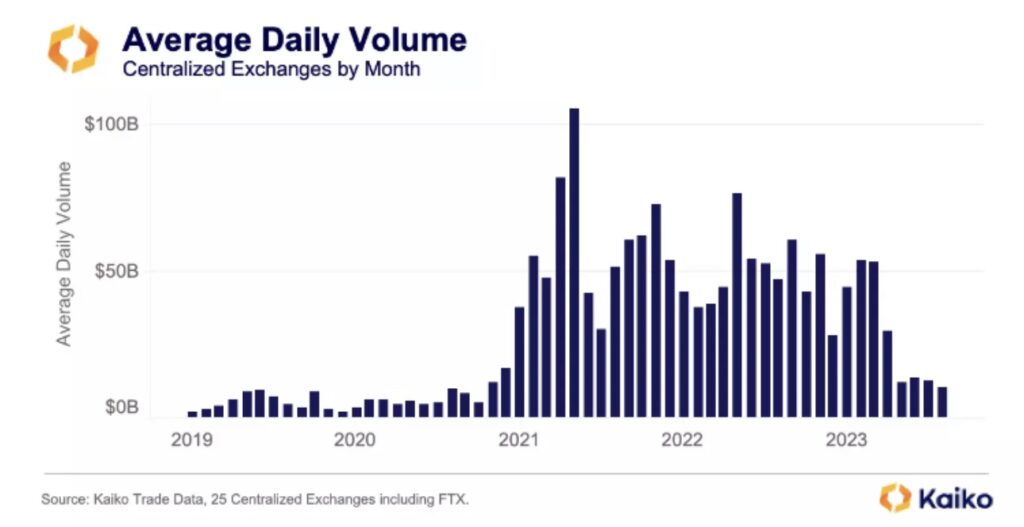

Bitcoin’s recent decline is its most significant since the FTX crypto exchange’s collapse in the last quarter of 2022. However, it’s worth noting that Bitcoin’s year-to-date gain remains at 57%, a decrease from 90% in mid-July. The crypto landscape has seen a decline in engagement from both retail and institutional investors, primarily due to last year’s market crash, events like the FTX debacle, and an ever-evolving regulatory environment. Data from research company Kaiko underscores this trend, revealing that average daily spot volumes on centralized digital-asset exchanges over the past four months were the lowest since October 2020, a time when Bitcoin was valued at approximately $10,000.

In conclusion, while Bitcoin and the broader crypto market face challenges due to global economic uncertainties, the industry remains hopeful for potential catalysts that could reignite interest and investment in the sector.