Consumer caution makes us a bit nervous for its retail business, but last week’s Azure results bode pretty well for AWS

Amazon (AMZN) is on the brink of releasing its Q2 results, and the anticipation is mixed. There are indicators suggesting a promising quarter, particularly for AWS, while the retail business could be a potential area of concern due to cautious consumer spending. Here’s an in-depth preview of what we might expect from the report.

Financial Overview

Earnings Expectations

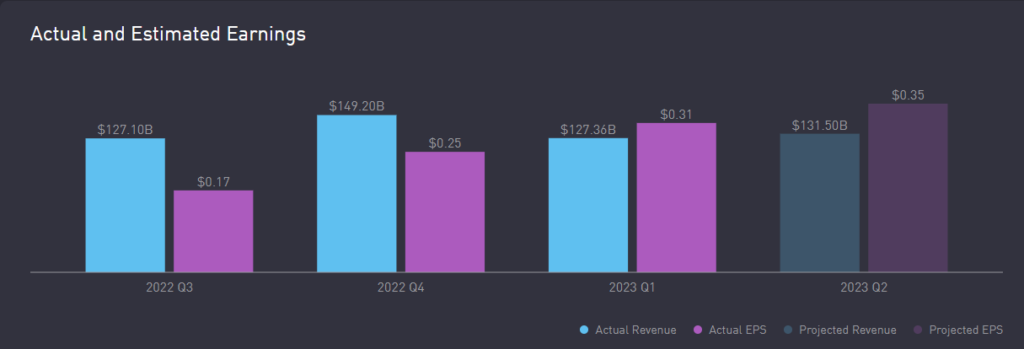

- Profit Estimate: The consensus calls for a profit of $0.35 per share, up from a loss of $(0.20) a year ago.

- Revenue Growth: Revenue is predicted to grow by 8.5% year over year to $131.49 billion.

- Operating Income Guidance: AMZN previously guided a Q2 operating income of $2.0-5.5 billion, reflecting their typical conservative approach.

Last Quarter’s Performance

Last quarter, Amazon’s results were highly encouraging:

- Earnings per share (EPS) and revenue exceeded expectations.

- Operating income was pleasantly above prior guidance.

Concerns Regarding Consumer Spending

Consumer caution is a prevalent concern going into this report. Amazon has noted that macroeconomic factors continue to drive conservative spending, with customers focusing on budgeting and lower-priced items. The emphasis on thrifty spending is contributing to a shift in consumer behavior and may affect Amazon’s retail business.

Amazon Web Services (AWS)

Current Trends

- Q1 Growth: +16% growth in constant currency (CC), continuing a downward trend.

- Cost Optimization: Customers are prioritizing cost-saving measures, described as “cost optimizing” rather than “cost cutting.”

Comparison with Azure

- Microsoft Azure’s Performance: Azure posted a +27% CC growth, a favorable sign for AWS.

- SepQ Azure Guidance: At +25-26% CC, it’s a robust figure, providing optimism that AWS might stabilize.

Prime Day and Other Factors

While Prime Day occurred in July and won’t be part of the Q2 results, it may still be a topic of interest during the call. Investors will be keen to hear insights into Prime Day performance, and any commentary provided will likely affect market sentiment.

Final Thoughts

The report is balanced with promise and uncertainty. The retail side, weighed down by cautious consumer spending, raises questions. However, AWS offers a brighter outlook, especially following positive results from Azure.

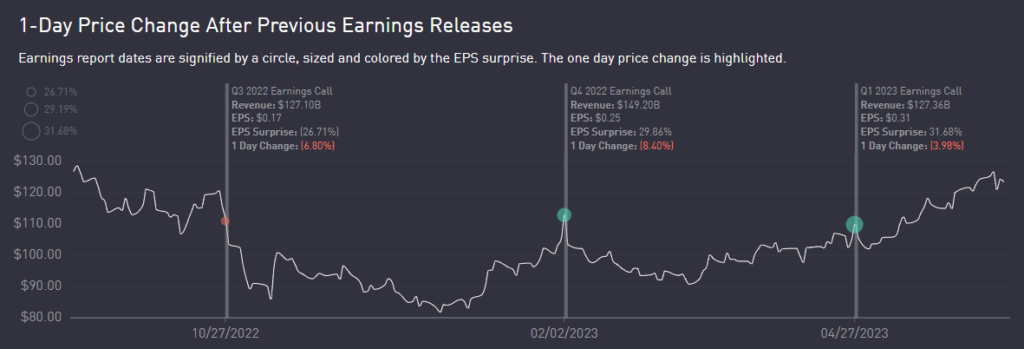

Investors are demonstrating tentative optimism as Amazon’s stock made significant strides in the spring but has leveled off during the summer. This trend might signify underlying anxiety about the upcoming report, hinting at potential upside if the numbers prove encouraging.

Ultimately, tonight’s report will provide a detailed picture of Amazon’s performance amid current market dynamics and may set the tone for the company’s trajectory in the coming months. The market will be eagerly awaiting the report and the subsequent call at 5:30 pm ET, with a close eye on both the retail and AWS segments, to gauge Amazon’s resilience and growth potential in a cautious consumer environment.