Apple Inc., a world-renowned technology giant, is due to announce its third quarter earnings tonight. The conference call for the announcement is scheduled for 17:00 ET. This report will examine the expected results, the recent trends in the company’s financial performance, and the potential market reactions. It’s important to note that the company’s valuation currently stands at $3.02 trillion and it trades at 32 times FY23 earnings.

Overview of Q3 Expectations

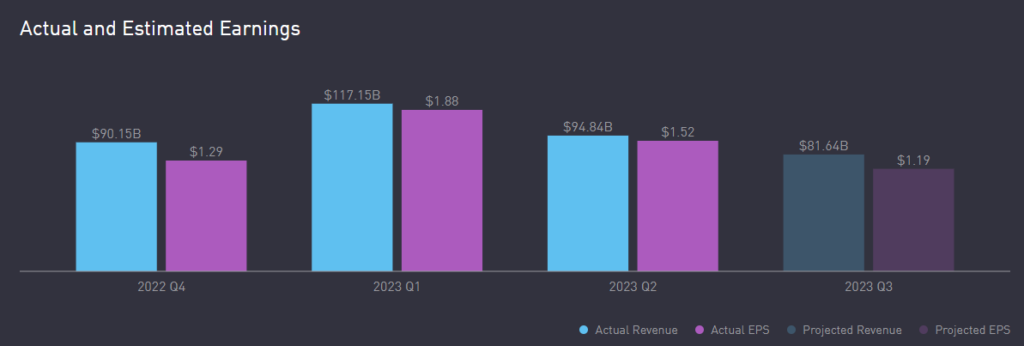

For Q3, the FactSet consensus predicts an EPS of $1.20, which is identical to the figure from last year. The revenue is expected to decline slightly by 1.4% year-over-year, amounting to $81.8 billion. The company has signaled that its performance in the June quarter will be similar to that of the March quarter. However, foreign exchange rates are expected to negatively impact the revenue by 4%. The services revenue growth is projected to remain stable, matching the rate of the March quarter. Moreover, the gross margin is forecasted to be between 44.0% and 44.5%.

The company has altered its practice of providing exact guidance in the press release since the pandemic, and now tends to give more vague guidance during the conference call. The Q4 FactSet consensus predicts an EPS of $1.36 and revenues of $90.2 billion.

Revenue Breakdown and Market Expectations

The market is anticipating Q3 iPhone revenue to reach $40.1 billion, slightly lower than the $40.7 billion recorded last year. Mac revenue is projected to be $6.3 billion, down from $8.2 billion last year, while iPad revenue is forecasted to be $6.5 billion, which is also lower than the $7.2 billion of the previous year. However, wearables revenue is expected to rise to $8.5 billion, up from $8.1 billion last year, while services revenue is projected to increase to $20.4 billion, up from $19.6 billion last year.

Given the importance of suppliers in Apple’s manufacturing process, several key names are worth noting. These include Skyworks Solutions (SWKS), Cirrus Logic (CRUS), Broadcom (AVGO), Qorvo (QRVO), Taiwan Semiconductor Manufacturing (TSM), and Qualcomm (QCOM). Samsung (SSNLF) and LG Display (LPL) are significant for display production, while Lumentum (LITE), Finisar (FNSR), and II-VI (IIVI) play key roles in the production of FaceID technology.

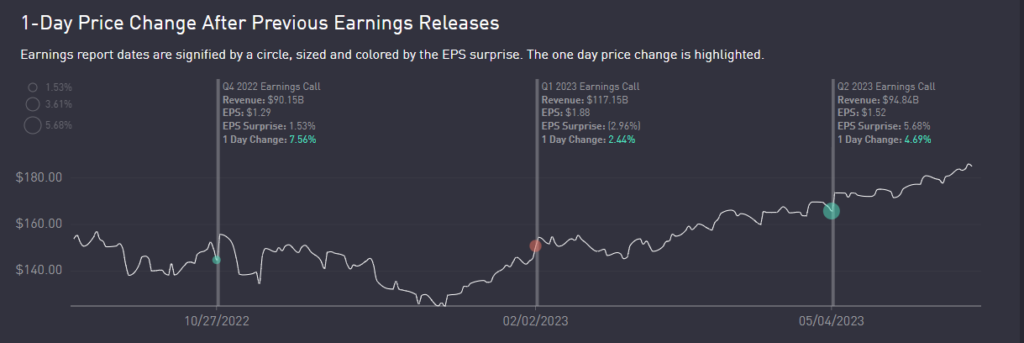

Options Market Reaction

The options market, as indicated by the AAPL Weekly Aug04 $192 straddle, is currently pricing in a move of approximately 4% in either direction by the weekly expiration on Friday.

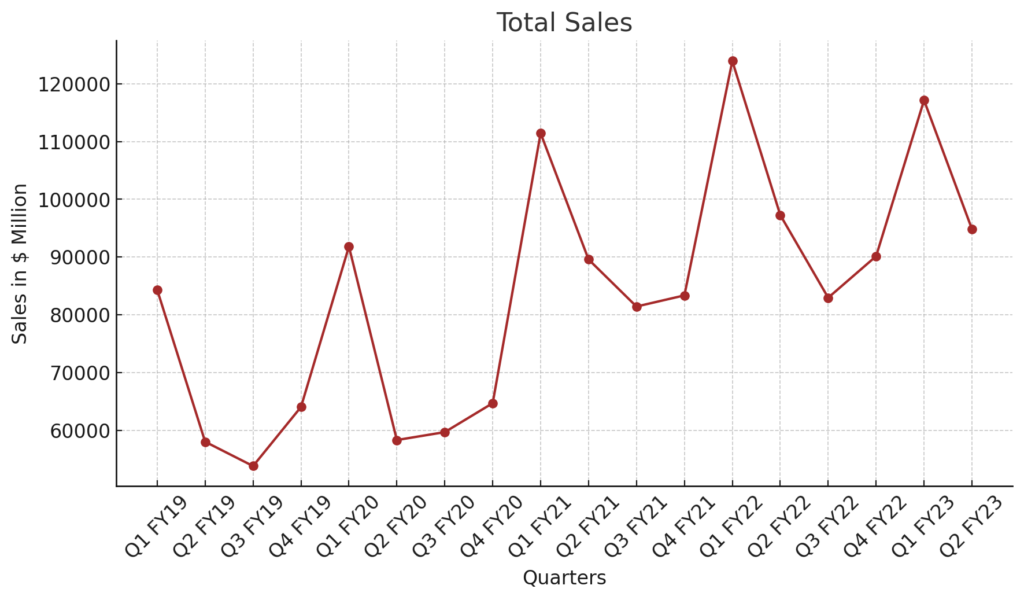

Revenue Trends: A Historical Perspective

To better understand the expected Q3 results, it is useful to examine Apple’s revenue trends for various product categories over the last few years. The following analysis considers iPhone, Mac, iPad, and wearables sales, as well as service sales, from Q1 FY19 to Q2 FY23.

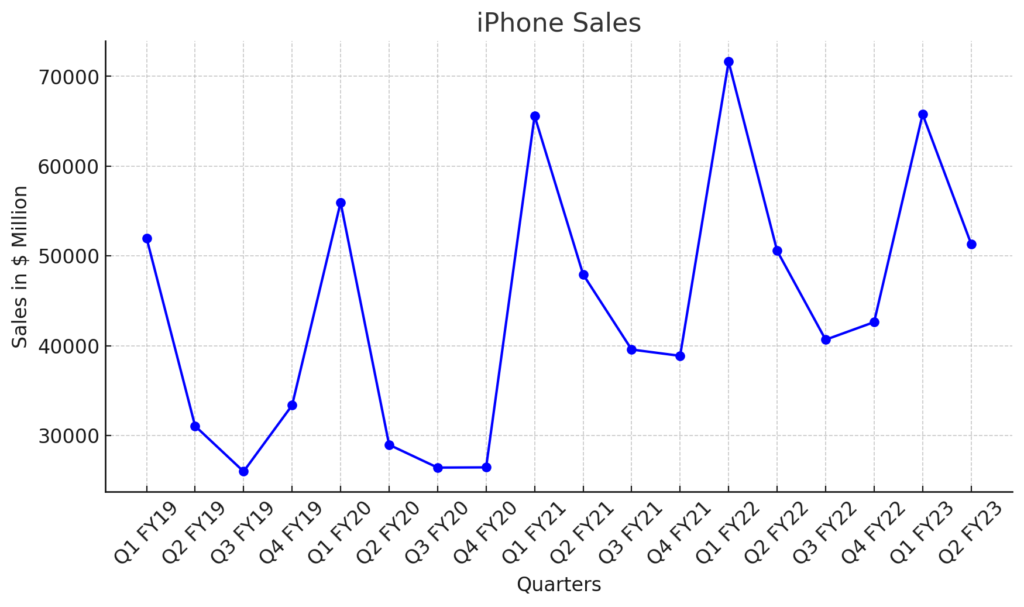

iPhone Sales

From Q1 FY19 to Q2 FY23, iPhone sales have shown both growth and decline. The sales dipped by 15% in Q1 FY19 but bounced back with an 8% growth in Q1 FY20. The highest growth was witnessed in Q4 FY21 at 50%. However, a slight negative growth of -8% was observed in Q1 FY23.

Mac Sales

Mac sales showed a similar pattern. After a 9% growth in Q1 FY19, sales dipped by -5% in Q2 FY19. However, a strong growth of 70% was recorded in Q2 FY21. Like iPhone sales, Mac sales experienced a significant drop of -29% in Q1 FY23.

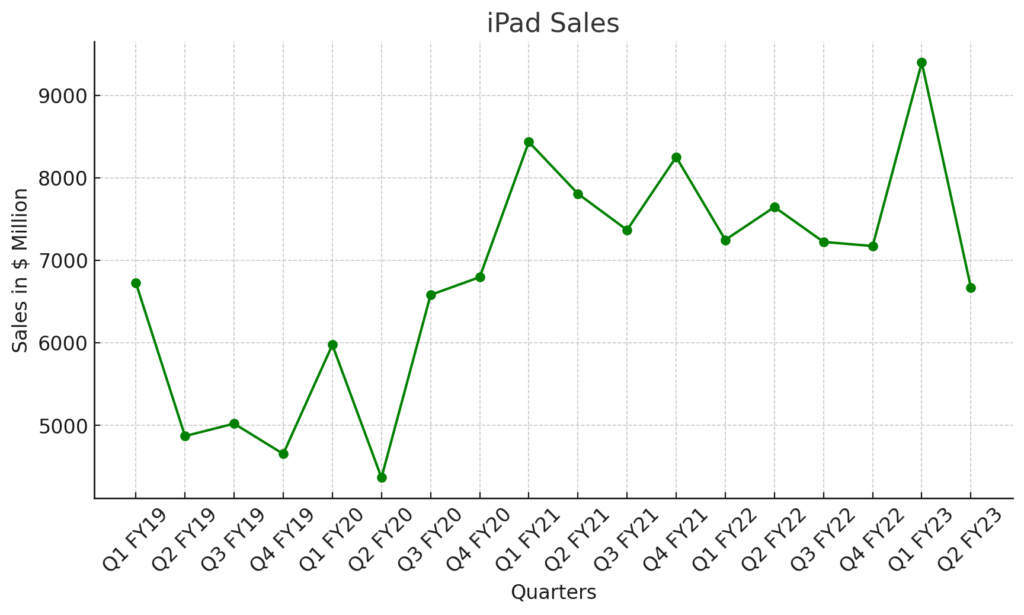

iPad Sales

iPad sales also experienced a mixed trend. An initial growth of 17% in Q1 FY19 was followed by a -11% decline in Q1 FY20. The highest growth of 79% was seen in Q2 FY21, but a drop of -14% followed in Q1 FY22.

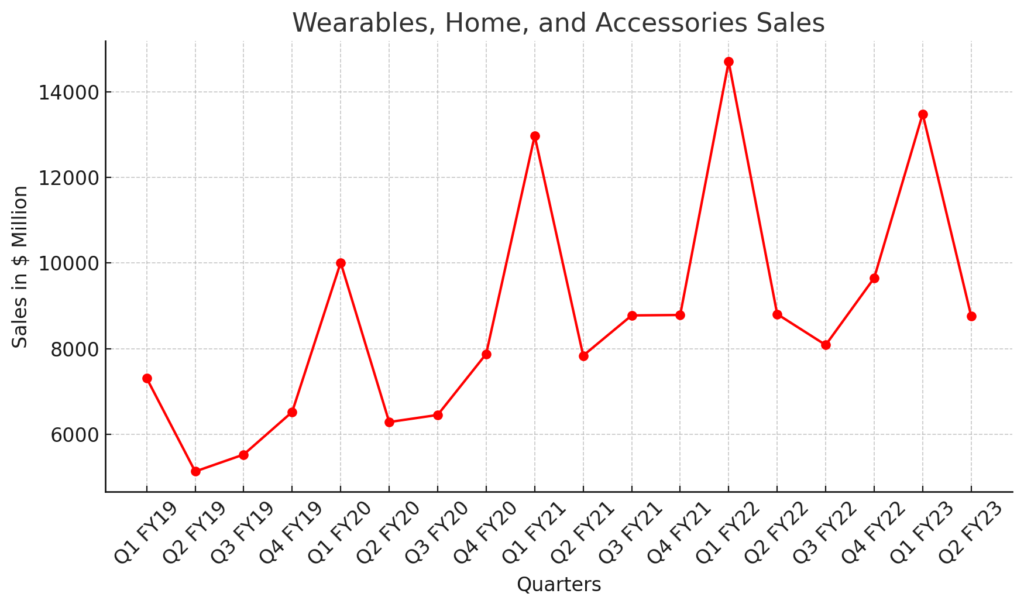

Wearables, Home, and Accessories Sales

This category showed a strong growth trend until Q4 FY22, with the highest growth of 54% in Q4 FY19. However, a slight negative growth of -8% was recorded in Q1 FY23.

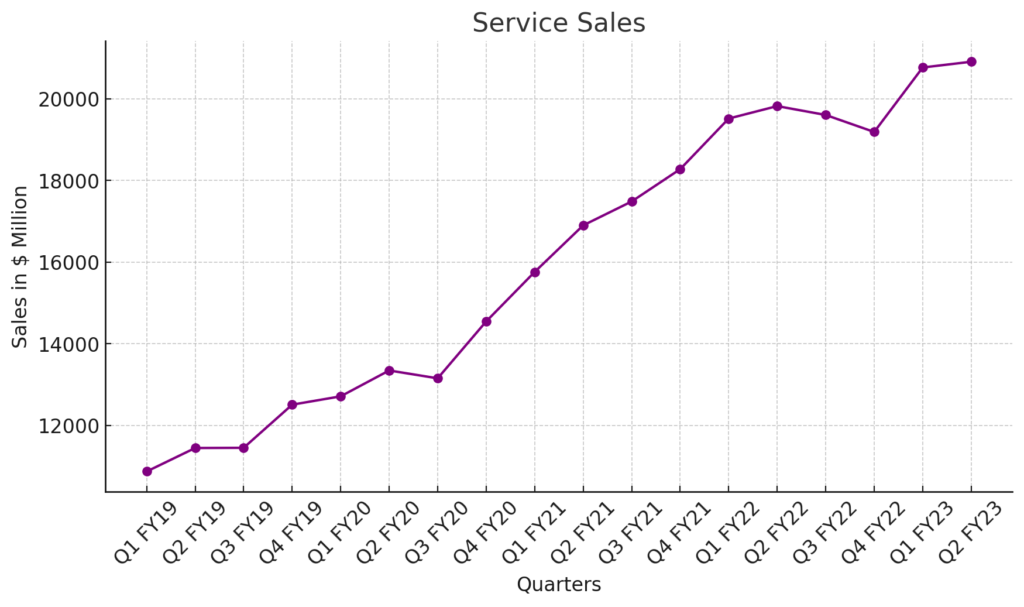

Service Sales

Service sales maintained a steady growth trend from Q1 FY19 to Q2 FY23. The growth rate ranged from 13% to 33%, with the highest growth recorded in Q3 FY21.

Based on these trends, the market expectations for Apple’s Q3 earnings will be closely watched. The results will provide an important indicator of the company’s current performance and future prospects.