Introduction

In the ever-evolving world of stock markets, fast-money stock skeptics who faced significant losses in July are making a bold comeback. The dynamics of the market are shifting, and the recent data suggests a notable trend in short sales, especially among hedge funds.

The Surge in Short Sales

According to Goldman Sachs Group Inc.’s prime brokerage unit, hedge funds, known for their bullish and bearish equity wagers, have increased their short sales in eight out of the ten sessions leading up to Monday. By mid-August, the dollar value of these bearish wagers has skyrocketed, more than doubling the volume of positions covered in July. This data, compiled by a team including Vincent Lin, provides a clear indication of the market’s current sentiment.

Morgan Stanley’s Observations

Morgan Stanley’s securities lending desk has also noticed this trend. There was a significant increase in short sales, especially among individual stocks. In fact, Wednesday and Thursday of the same week recorded the second and fourth busiest sessions of the year, respectively.

The Speed of Market Movement

While it’s common for short sales to increase as markets decline, the rapidity of their current deployment is worth noting. Hedge funds have recently withdrawn from the markets at a pace that some analysts describe as the quickest since the retail-driven short squeeze of 2021. Vincent Lin commented on this, stating, “Trading flows point to a reversal in trends.”

The Underlying Forces

The S&P 500 is currently experiencing its most challenging month of the year, with a potential connection to the rise in bond yields. Other factors contributing to this downturn include traders in zero-day options and market markers whose shift in derivatives positioning has caused market upheaval.

The S&P 500’s Performance

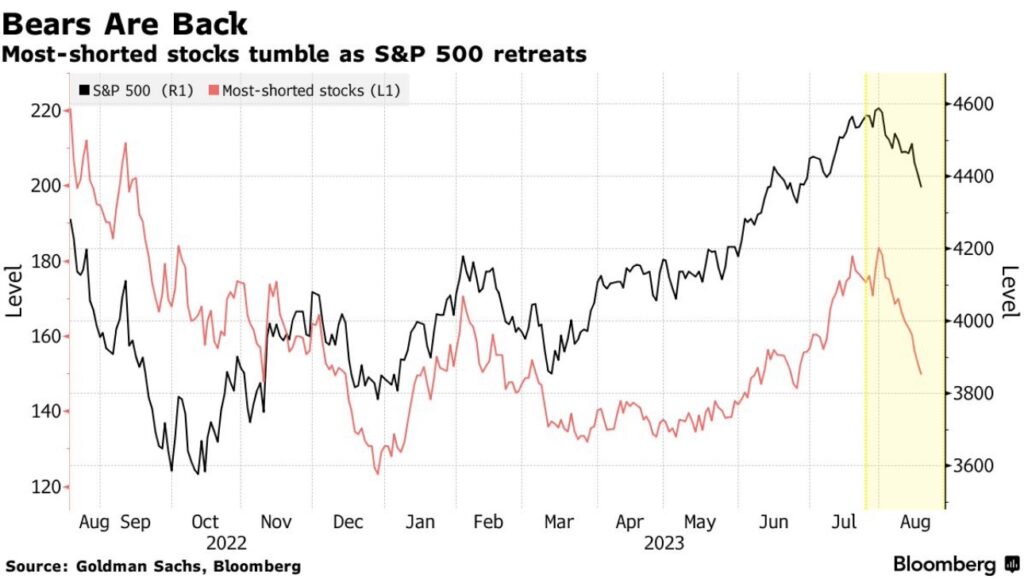

As the S&P 500 is on the brink of its third consecutive weekly decline, the index has decreased by 5% in August. In contrast, a basket of the most-shorted stocks, as tracked by Goldman, has plummeted by 18%, leading to significant profits for bearish investors.

A Potential Market Bounce?

For optimistic investors who use sentiment as a gauge for market trends, this renewed skepticism might be a silver lining. History has shown that such skepticism can pave the way for a market rebound. A similar scenario played out last October when the majority were bracing for a recession. However, as positive economic and earnings data emerged, stocks surged, prompting investors to pursue gains.

The Uncertainty Ahead

The current market conditions and whether they signify a pivotal moment remains a mystery. Recent data from Bloomberg indicates that flows into equity-focused exchange-traded funds have turned negative. Furthermore, a survey by the National Association of Active Investment Managers (NAAIM) revealed a decline in equity exposure.

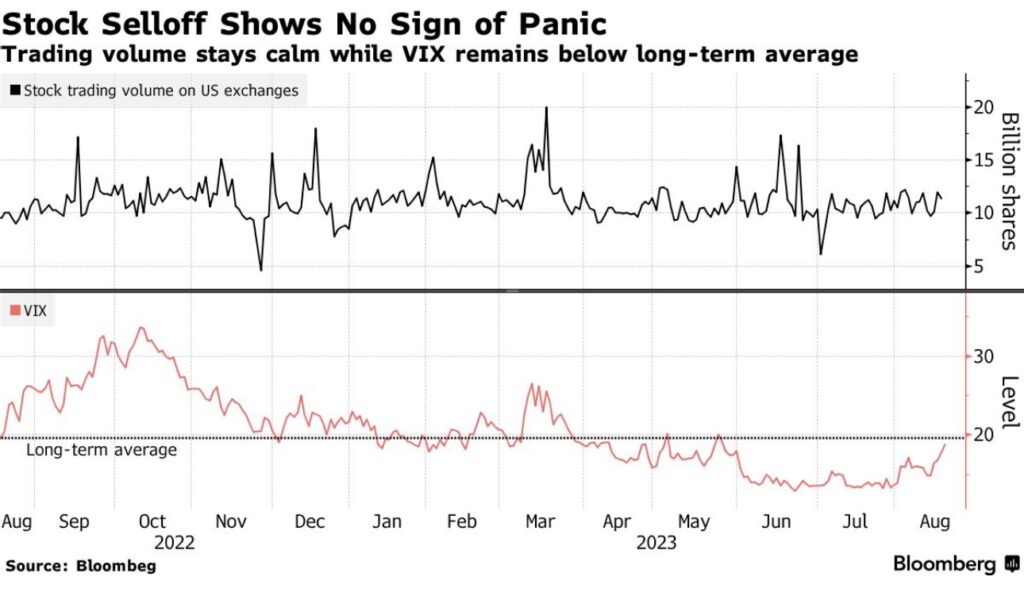

However, the market hasn’t shown the urgency typically associated with a market bottom. Trading volumes remain consistent with the 2023 average. The Cboe Volatility Index, which measures the cost of options, has risen from this year’s lows but is still below its historical average. JPMorgan Chase & Co.’s prime brokerage unit, including John Schlegel, noted a similar trend among hedge funds, suggesting it might be premature to declare a market recovery.

Conclusion

The stock market’s landscape is ever-changing, with recent trends indicating a surge in short sales. While some see this as a potential precursor to a market rebound, others remain cautious. As JPMorgan’s team aptly put it, “The markets could be somewhat weak for a little longer… It’s not clear we’ve seen capitulatory selling.” Only time will tell how these dynamics will play out in the broader market.