Deep within the intricate corridors of the options world, a subtle yet looming menace threatens the tranquil waters of the stock market we’ve experienced this year. To the untrained eye, everything may seem steady, but a closer look reveals a different narrative.

The S&P 500’s Intraday Moves

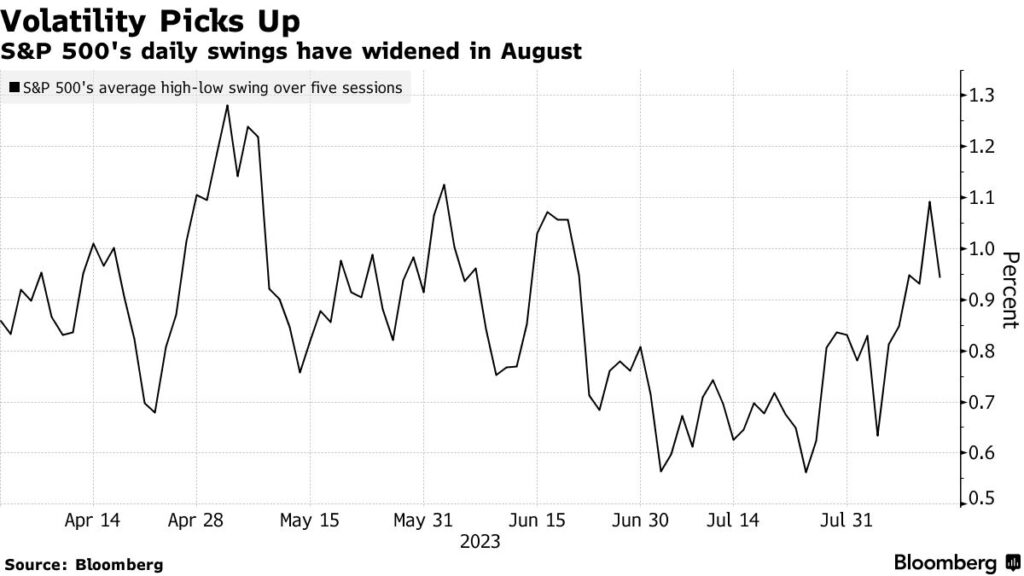

While benchmark indexes have barely shown any significant weekly changes in 2023, the intraday movements tell a captivating tale. The S&P 500’s up-and-down swings have become the most pronounced since June, a stark increase from last month. The index’s futures have seen a 0.9% gain wiped out twice in the past six sessions, an anomaly not witnessed since February. What’s the reason behind this?

A Dual Catalyst: Economy and Market Makers

Undoubtedly, apprehensions regarding the economy and central bank policies have stirred the pot. However, another less-discussed force is also at play: the repositioning of exposures by market makers. These Wall Street juggernauts, equipped with the power to shift millions of shares for hedging purposes, appear to have transitioned to a stance that intensifies market swings. This change is notably different from the calming influence they had during the first seven months of the year, as highlighted by Scott Rubner of Goldman Sachs Group Inc. Rubner observed, “Market moves are exacerbated, and no longer muted. This is new.”

The Stock Market’s Current State

Recent trends have not been kind to stocks. Mixed inflation data, coupled with debates around the Federal Reserve’s rate hikes and recession concerns, have put the market on shaky ground. The S&P 500 witnessed a decline of 0.3%, and the Nasdaq 100 has been on a downward trajectory for two weeks, shedding 4.6% of its value.

Furthermore, data from Bloomberg underscores the market’s volatility. The S&P 500 experienced an average intraday swing of 1.1% for five sessions through Thursday, a jarring movement not seen since June and almost double the average daily shift from just a fortnight ago.

Tom Hainlin, a strategist at US Bank Wealth Management, expressed concerns, stating, “People are trading on the two range of outcomes, so you’ve got this push and pull.”

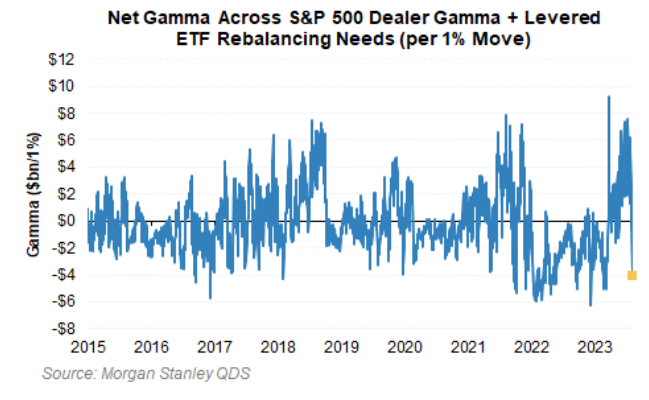

The Role of Gamma in Market Dynamics

In the options world, ‘gamma’ is a term that holds considerable weight. It represents the theoretical stock value that option dealers might need to purchase or sell to hedge against potential directional risks. While evaluating the interplay between the vast derivatives universe and underlying shares is no small feat, it offers a glimpse into the possible repercussions of the derivatives realm on the cash market.

Presently, trading desks at Wall Street giants like Goldman and Morgan Stanley are sounding the alarm, cautioning about potential market turbulence. They’ve observed a notable shift in option dealers’ positioning, moving away from their “long gamma” stance. This transition implies that the market is more vulnerable to larger swings, especially when combined with the actions of leveraged ETFs.

The Market’s Current Sentiment

Following a robust 10-month rally that saw the S&P 500 soar by 28%, investors have become wary, especially with the index’s price-earnings ratio reaching heights seen only twice in the past 30 years. According to data from EPFR Global cited by Bank of America Corp., funds focusing on US stocks have experienced outflows for the first time in three weeks.

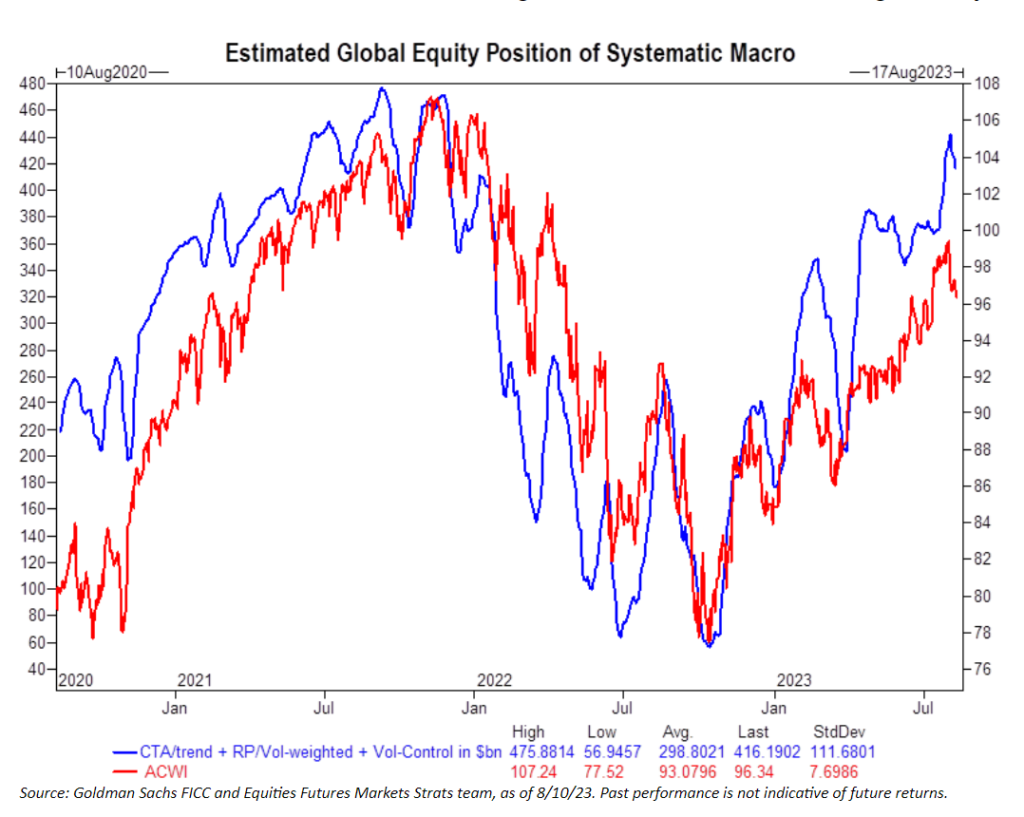

Rubner of Goldman Sachs highlighted another potential concern. Systematic money managers, driven by the year’s consistent equity rise, have been avidly buying stocks. But if the market continues its downward trajectory, a massive unwinding could be triggered, leading to significant market upheaval.

The Importance of Volatility

Throughout 2023, US stocks have generally maintained an upward trend with minimal volatility. The Cboe Volatility Index (VIX) has remained below its long-term average, indicating a relatively peaceful year reminiscent of 2019. However, a surge in volatility could change the game.

Bob Elliott, Chief Investment Officer at Unlimited, opined on the situation. According to Elliott, the low volatility played a crucial role in the stock market rally. But, a shift towards a more volatile environment could limit investors’ risk appetite, potentially dragging down asset prices and the broader economy.

The stock market’s recent behavior, combined with the actions and positions of significant players, paints a complex picture. While the market’s trajectory remains uncertain, it’s clear that volatility is reclaiming its position as a formidable player in the market dynamics. Investors and stakeholders must remain vigilant and be prepared for the unpredictable twists and turns that lie ahead.